Last month, we had the great pleasure to host the 4th Global Risks Conference, organised by the Luxembourg Association for Risk Management with the participation of the World Economic Forum. Let me recap on some of the thoughts that crossed my mind during the conference…

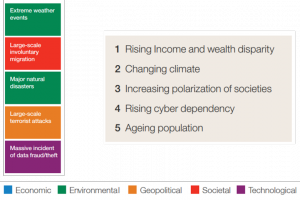

While there is no magic cure for dealing with risks and uncertainty, there is a way to cope with them in a pragmatic approach: we can take calculated risks. I suggest we take a closer look at these very risks in the first place and analyse the ensuing needs and measures to adopt for the Luxembourg economy in a second step. A useful summary is provided by the 12th edition of the World Economic Forum’s Global Risks report that features the top 5 global long-term risks, drawing on the expectations and assessment of experts and international decision-makers.

The top 5 risks on the left show that there is great need for a more environmentally responsible growth model and improved international cooperation be it on the level of immigration politics, security and defence or data protection. The top 5 trends that determine Global Developments (in the box) hint at similar requirements and emphasize the need for a reinforced social cohesion, which is one of Luxembourg’s greatest socio-economic strong suits and also a fundamental element in the Grand-Duchy’s economic success story. And yet we should not take it for granted as events and trends like Brexit, anti-establishment populism and intensifying national sentiment can have a strong influence on important societal values of which social cohesion is one of the most important if not the most important. Luxembourg is not an isolated island, we will thus need a yet more inclusive growth model. While some paths can be paved on a European level, others are home-made.

The top 5 risks on the left show that there is great need for a more environmentally responsible growth model and improved international cooperation be it on the level of immigration politics, security and defence or data protection. The top 5 trends that determine Global Developments (in the box) hint at similar requirements and emphasize the need for a reinforced social cohesion, which is one of Luxembourg’s greatest socio-economic strong suits and also a fundamental element in the Grand-Duchy’s economic success story. And yet we should not take it for granted as events and trends like Brexit, anti-establishment populism and intensifying national sentiment can have a strong influence on important societal values of which social cohesion is one of the most important if not the most important. Luxembourg is not an isolated island, we will thus need a yet more inclusive growth model. While some paths can be paved on a European level, others are home-made.

In this regard, we should bear in mind that our economy today is mainly driven by extensive growth, meaning that GDP growth is a result of the increase of production factors – more employments, more resources. While gross added value in the market sector has gone up by 10.9% and the number of hours worked has increased by 14.6% between 2007 and 2015, productivity has decreased by 3.2% over the same time period. The numbers clearly confirm the need of a more intelligent way of using (but also distributing) available resources.

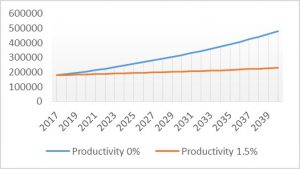

Being incapable of reversing our current growth model also means being trapped in the vicious circle of extensive growth, demanding more workers from abroad. Let’s imagine that productivity keeps stagnating at 0% growth with GDP growth standing around 3% a year. Based on these assumptions, the number of cross-border workers (blue curve in the graph) would increase to 480,000 by 2040 from 175,000 today.

If, on the contrary, Luxembourg would manage to increase labour productivity by 1.5% a year as of next year, the total number of required cross-border workers would be around 230,000 by 2040, thus “only” 55,000 more than currently (but their professional skills set must match the labour market needs which is a different challenge that will be addressed later). The same level of economic growth could thus be maintained without necessarily recruiting workers from our neighbouring countries.

A critical stepping stone towards increased productivity is arguably a good command of digitisation and the Third Industrial Revolution. New technological trends like data analytics, automation, 3D printing, robotics, the internet of things and artificial intelligence will however not only rewrite the economic playbook. The labour market will be affected by equally significant changes. Will our children be sitting in a driverless bus tomorrow? Are robots the better surgeons? Will cash become obsolete as we pay for everything using mobile phones? Will workers in the construction sector be replaced by 3D printers? This type of questions has become increasingly popular… Besides, digitisation will alter the way we work and the way work is organised. Individualisation, work-life balance or project-based working are far from being marketing buzzwords.

While digital natives will either grow up with these new work models and circumstances or adapt quickly, the previous generations might struggle to do so. But that is not the only element that might split up society into parallel societies isolated from each other, potentially leading to a collapse of social cohesion. In addition to the generational divide, Luxembourg also needs to address the risks related to the electoral divide and the perennial issue of private versus public employment. Not to mention the discrepancy between the traditional and the more innovative sectors in terms of technological readiness and adaptive capacity.

Retail and wholesale trade as well as the Horeca sector and other very small businesses in these sectors figure for instance among the traditional players. They are important pillars of our economy but they are not always at the very forefront of innovation. And then I would mention space mining, circular economy, automotive components and high performing computing as highly innovative niche sectors. They are less risk averse and more R&D intense.

So while the latter will most probably experience a smooth transition towards even more innovative activities, the former might need assistance and support to make their way in this ever-changing environment. They need to be informed, they need to be accompanied and they need to be included in the process of the Third Industrial Revolution.

And let’s not lose sight of the usual suspects, our traditional home-made challenges such as pension expenditure (let me recall that pension reserves are expected to deplete between 2032 and 2040 depending on population growth), housing costs and transport infrastructures. And last but not least, I should recall the risk related to the correlation between the evolution of stock market indices and Luxembourg’s economic performance (the correlation coefficient is estimated at 70%[1]). While a drop by 10% of the Eurostoxx50 index is expected to result in a decrease of between 0.4 and 0.5 percentage points of GDP within one year[2], a slump by 10% of the LuxX index is estimated to entail a lowering of GDP by one percentage point[3]. That’s a pretty large amount of dynamite for such a small sized country. But dynamite does no harm when monitored.

So what’s needed? Two key elements are change management and a change in attitude and habits. By and large, Luxembourg is doing pretty well. Given its high purchasing power, there is obviously less need for critical thinking, self-challenging and reassessment than in other countries. But this time, Luxembourg will have to leave its comfort zone in order to earn its name as a first mover. We will have to invest in education, upskill, develop local skills, innovate, foster research and development as well as entrepreneurship and build resilience. In the 2017 edition of the IMD World Competitiveness Yearbook, the Grand Duchy ranks 18th out of 63 countries worldwide which is a decent, but far from excellent performance. Less exposure to external shock and less reliance on foreign demand by means of a more inclusive and diversified growth strategy – that is what we should aim at.

Luxembourg needs a new compass, the old maps do not serve us any longer. It would be misleading to adhere to habits and outdated standards. The secret of inclusive growth and long-term well-being is to embrace progress while addressing the concerns raised by those who might feel overwhelmed or left behind. As mentioned earlier, social cohesion is one of the main pillars of the Luxembourg success story. Rising income and wealth disparity and the increasing polarisation of societies being two major global risks that were identified in the Global Risks report, we should make social cohesion a priority or overarching target that can be reached by a new approach to generate economic growth and remain competitive and attractive. An approach that inevitably involves a more efficient use of resources (human, natural …), a solid productivity boost and the active promotion of a real level playing field on an international scale.

But while on the beach or in the mountains – enjoy your holiday and we’ll continue these discussions in a month’s time!

[1] Source : Larue Bastien (2016), Regards 21 sur la relation entre fluctuations boursières et performance économique. STATEC.

[2] Source : STATEC, Note de conjoncture 2015.

[3] Source : Hennani Rachida (2017) Performance économique et marchés boursiers : le cas du Luxembourg. Fondation IDEA.