Attractiveness and competitiveness are two sides of the same coin. Good performance and a favourable ranking on these two indicators are pre-requisites for strong and steady corporate growth. This is especially true within the Luxembourg economy, which is small in size and particularly outward-facing. One indicator with a direct influence on companies’ performance and the attractiveness and competitiveness of an economy is productivity.

German economic newspaper Handelsblatt (1) published the following in its issue of 4 May 2023:

« Es gibt nur wenige Zusammenhänge, auf die sich Ökonomen ohne Weiteres einigen können. Dieser gehört dazu : F&E-Investitionen schaffen Innovationen, Innovationen erzeugen Fortschritt, Fortschritt erhöht die Produktivität und eine wachsende Produktivität ist der einzige Weg, um unseren Wohlstand zu erhöhen – ohne immer länger zu arbeiten, immer mehr Schulden zu machen oder unsere Umwelt immer stärker zu verschmutzen. » (2)

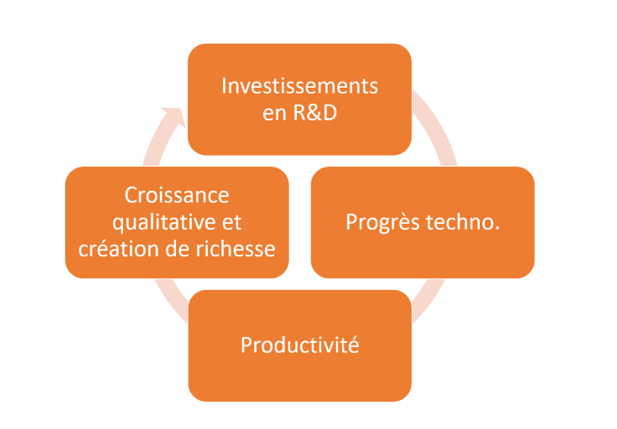

R&D investment leads to innovations, innovations generate progress, progress increases productivity, and rising productivity is the only way to boost our prosperity – without working for longer, taking on more debt or further polluting our environment.In other words, higher productivity is a source of value creation, helping to enhance the competitiveness of companies and the attractiveness of the economy.

We are therefore looking at a virtuous circle forming the basis for qualitative growth – the much-vaunted “doing more with less”.

Making factors of production (such as workers, capital and natural resources) more productive allows for more rational use of resources, which is a pre-requisite for sustainable development. The quotation from Handelsblatt also refers to the impact of productivity on the length of our working lives, which is an important matter in the context of the labour and talent shortage and an ageing population.

It also affects the effectiveness of public finances, given that the “whatever it takes” (3) approach currently followed in Europe – and in Luxembourg at the three most recent tripartite meetings – can hardly be described as sustainable over the longer term.

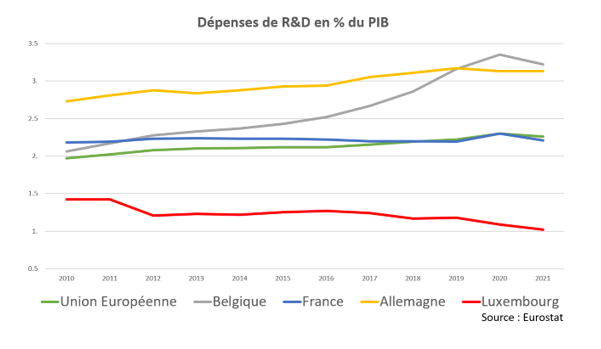

Where do we stand in Luxembourg? We could simply say that the country is doing well, especially compared with its three neighbours. Its AAA status has been confirmed by several rating agencies, it continues to create jobs, and it demonstrated excellent resilience during the pandemic, as it had in the financial crisis of 2008. There are, however, certain concerning changes adversely affecting our competitiveness and attractiveness. Above all, it matters that these are “home grown” and therefore more a question of structure than of outlook. Let’s consider the example of R&D intensity – in other words, the level of research and development compared with total value added produced. Spending on the R&D system stood at just 1.02% of GDP in 2021. This was well below the EU average, which was 2.26%, and also below that of neighbouring countries. It is also important to note that R&D intensity is increasing in other countries, whereas it is stagnating, or even decreasing, in Luxembourg.

The concerning point is not so much that we are lagging behind the European average. This is the case because industry accounts for a smaller share of total value added in Luxembourg (6%) than the average across the continent (10-15%). The particularly worrying point is the downward trend, since this intensity, which is falling in Luxembourg, could delay the crucial investments we need to conduct our digital and environmental transition and thereby prepare companies for the future.

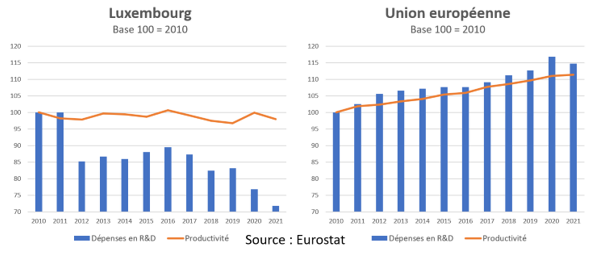

Another problem is that our productivity curb has been flat for the past decade, while the level of investment in R&D is falling. Over the same period, at European level, these two indicators – which are well correlated with one another – have increased at the same rate.

Is it any surprise, in these circumstances, to see workplace productivity stagnating in Luxembourg but increasing elsewhere in Europe?

Of course, our low level of investment in research and development is not the only reason why our productivity is stagnating. Fortunately, the absolute level of productivity has historically been higher than in most European countries! We should therefore aim to leverage this once again, and restart the virtuous circle described above.

As well as engaging in research, innovation and training, we can increase productivity by enhancing efficiency through, for example, digitalisation, simplifying administrative and tax procedures, infrastructure optimisation and better public governance. We can also do this indirectly by cutting corporation tax.

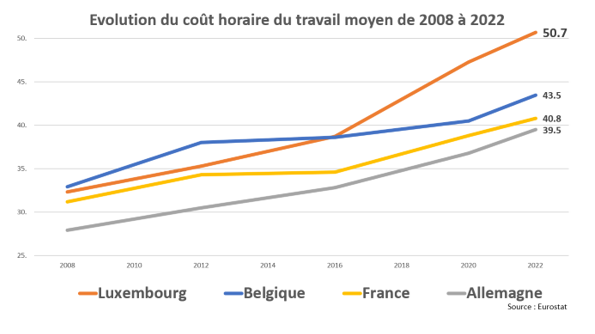

Another competitive disadvantage for our companies is the cost of labour. This is among the highest in Europe, despite very competitive social security charges, at least historically. In 2022, the average hourly labour cost in Luxembourg was above EUR 50.

Over the past 18 months, four additional tranches of wage indexation have considerably raised the cost of labour for companies. If these additional costs cannot be offset by productivity gains, businesses suffer a loss of profitability. This is particularly true for export companies that cannot feed higher costs into retail prices, since adjusting the final price tag directly harms their competitiveness on the international markets.

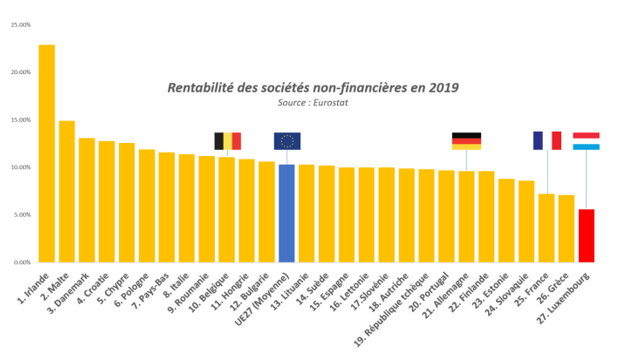

Furthermore, in the ranking for non-financial companies’ profitability we come dead last – well below the European average.

The finance and other corporate services sectors, especially in ICT, are luckily performing better in terms of profitability. Overregulation of the financial sector and a failure to systematically apply the principle of “the whole directive and nothing but the directive” in Luxembourg is also making our financial market – which remains the mainstay of our economy – more and more fragile.

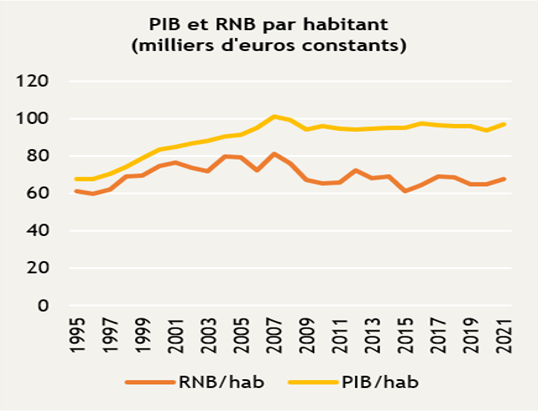

A company’s profitability and margins are what allow it to implement its business plan, produce, recruit, invest in the future and pay tax. Companies are therefore our main sources of wealth creation. Two value creation indicators have been stagnating since the 2008 financial crisis. These are the GDP per inhabitant and the gross national income per inhabitant, with the latter being more relevant to Luxembourg’s specific situation. It expresses the wealth created per inhabitant once all foreign production factors (so, cross-border workers, foreign investors and others) are paid.

In other words, the “pie” generated by our production system has scarcely grown at all in volume terms for 15 years, but it has to be shared among more and more people.

The pie is also taking more and more resources to produce – and at the same time we are spending more to “control” and “regulate” its quality, the production procedure, the ingredients, etc.

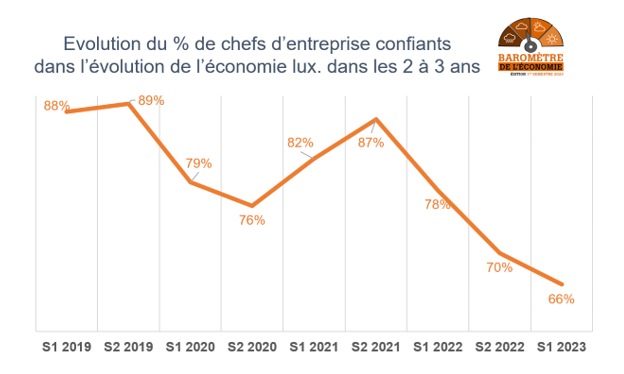

In light of these concerning structural developments, and in an atmosphere of uncertainty brought on by crisis after crisis, it comes as no surprise that entrepreneurs’ confidence is at a record low. The latest edition of the Baromètre de l’Economie (4) published by the Chamber of Commerce, to which 611 companies with at least six employees contributed, demonstrates this. We can see that confidence in the future of the Luxembourg economy is even lower now than during the pandemic. And yet confidence is what drives growth.

One factor affecting confidence is production cost. In the current inflationary context, triggered by energy costs, and scarcity and supply problems affecting certain raw materials and intermediary products, it is unsurprising that many companies are unhappy about the way in which the automatic indexation system affects salaries. This is expensive for companies, it exacerbates wage gaps and it results in firms that do not compete internationally raising end prices to factor in – at least partially – higher salaries. This then fuels inflation in a self-perpetuating cycle. The inflationary wave we are experiencing, which has generated four salary indexation adjustments in 18 months, has only demonstrated the extent to which indexation, as it exists today, can have harmful economic effects.

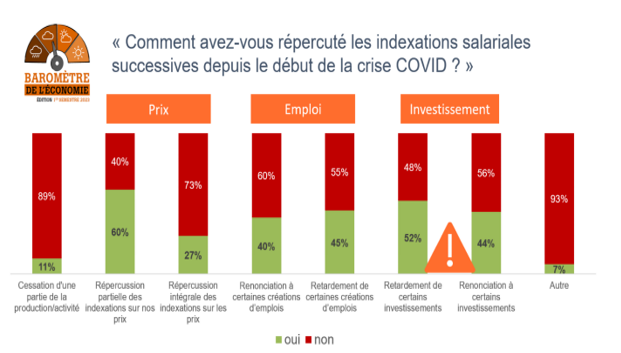

This is what the results of the Baromètre de l’Economie show. 60% of companies report having partially factored the successive indexation adjustments into their prices, and 27% have passed them on in full. The consequences for employment are also significant: 40% of entrepreneurs say they have given up plans to create jobs and 45% have delayed such plans. Lastly, indexation adjustments caused 52% of companies to postpone certain investment plans and 44% to cancel them outright, breaking the virtuous circle mentioned above.

Indexation has its virtues too, which is why the Chamber of Commerce is not calling for it to be abolished. Instead, we would like to see the system change in three cumulative areas. We believe that indexation should occur once a year, a sustainable basket should be created to serve as a basis for calculating the indexation and the related weightings, and indexation should be capped from 1.5 times the median salary and then degressive from 4 times the median salary.

Specifically:

- All employees earning up to 1.5 times the median income (EUR 5,310 per month gross in 2021 according to Eurostat) would have their wages indexed by 2.5% as at present. In this way, the purchasing power of the poorest households would be preserved. According to STATEC data, indexation would thus be fully maintained for over 70% of the country’s households.

- All employees earning between 1.5 times the median income (EUR 5,310) and 4 times the median income (EUR 14,140) would have their monthly salaries increased by a lump sum of EUR 133, corresponding to a 2.5% increase for 1.5 times the median income.

- All employees earning between 4 times (EUR 14,140) and 5 times the median income (EUR 17,700) would receive a degressive increase from EUR 133 to EUR 0.

- There would be no indexation for employees earning more than 5 times the median income (EUR 17,700).

If nothing changes, each new index tranche will drive inflation even higher, hinder employment and reduce investment.

In the Baromètre de l’Economie, we also asked business leaders about Luxembourg’s strengths and weaknesses with respect to attracting foreign investment, talent, R&D projects and industrial operations.

The strengths listed most often included political stability, the international, multicultural atmosphere, and infrastructure quality.

In terms of weaknesses, companies cited the cost of labour, as well as a shortage of talent, administrative complexity, excessive taxation, a lack of flexibility on remote working, the price of property and the lack of housing. Whereas quality of life has long been a key part of Luxembourg’s appeal, it has become difficult to move to our country and find somewhere to live.

This housing pressure, coupled with staff shortages and labour costs, is now one of the main obstacles preventing us from reindustrialising, which is essential if we are to make our economy diversified and resilient. There is hard work ahead if we are to bring cutting-edge manufacturing back to Europe, and rise to the challenge posed by the US Inflation Reduction Act, and our country must play its part. It is an economic, geopolitical and climate challenge.

Given the difficulties expressed by companies, the Chamber of Commerce is fulfilling its role as source of fresh ideas. In this pre-election period, our teams have drawn up a detailed status report and issued over 60 proposals. These are set out in the seven thematic booklets we are publishing at this time. Our hope is that these publications will put business interests at the heart of the electoral debate (5).

It will take courage and vision to maintain and increase the attractiveness and competitiveness of companies, and therefore the economy more broadly, especially by embracing innovative public policy and far-reaching reforms.

The French statesman Georges Clemenceau once said, “It’s important to know what you want. When you know it, you must have the courage to say it; when you say it, you must have the courage to do it.”

We all know what we want: healthy, high-performance companies and a prosperous economy to foster everyone’s well-being. Let’s have the courage and vision to swiftly undertake the reforms we need to make that happen.

[2] “R&D investment leads to innovations, innovations generate progress, progress increases productivity, and rising productivity is the only way to boost our prosperity – without working for longer, taking on more debt or polluting our environment”

[3] The phrase “whatever it takes” was first used on 26 July 2012 by Mario Draghi, then President of the European Central Bank, in reference to the means that would be used to save the euro, which was under threat from the public debt crisis. Since then, the concept has been taken up by various governments to justify public spending to avoid an economic collapse, especially during the pandemic.

[4] The Baromètre de l’Economie (Barometer of the Economy) is a half-yearly economic survey conducted by the Chamber of Commerce. 611 companies were surveyed for the H1 2023 edition. Full results will be presented to the media on 7 June 2023.

[5] Our seven thematic booklets (0. Learning lessons from successive tests and looking to the future; 1. Developing all talents within an attractive, efficient, and open labour market; 2. Accelerating the ecological and energy transitions with a business-friendly framework; 3. Laying the foundations of a competitive and innovative “data-driven economy”; 4. Steering territorial development to meet housing and transport needs; 5. Maintaining and increasing the attractiveness and competitiveness of the economic model; and 6. Guaranteeing sustainable public finances, pensions and social protection for all generations – to be published soon) are available for download (in French) at https://www.cc.lu/en/thematic-dossiers/elections-2023